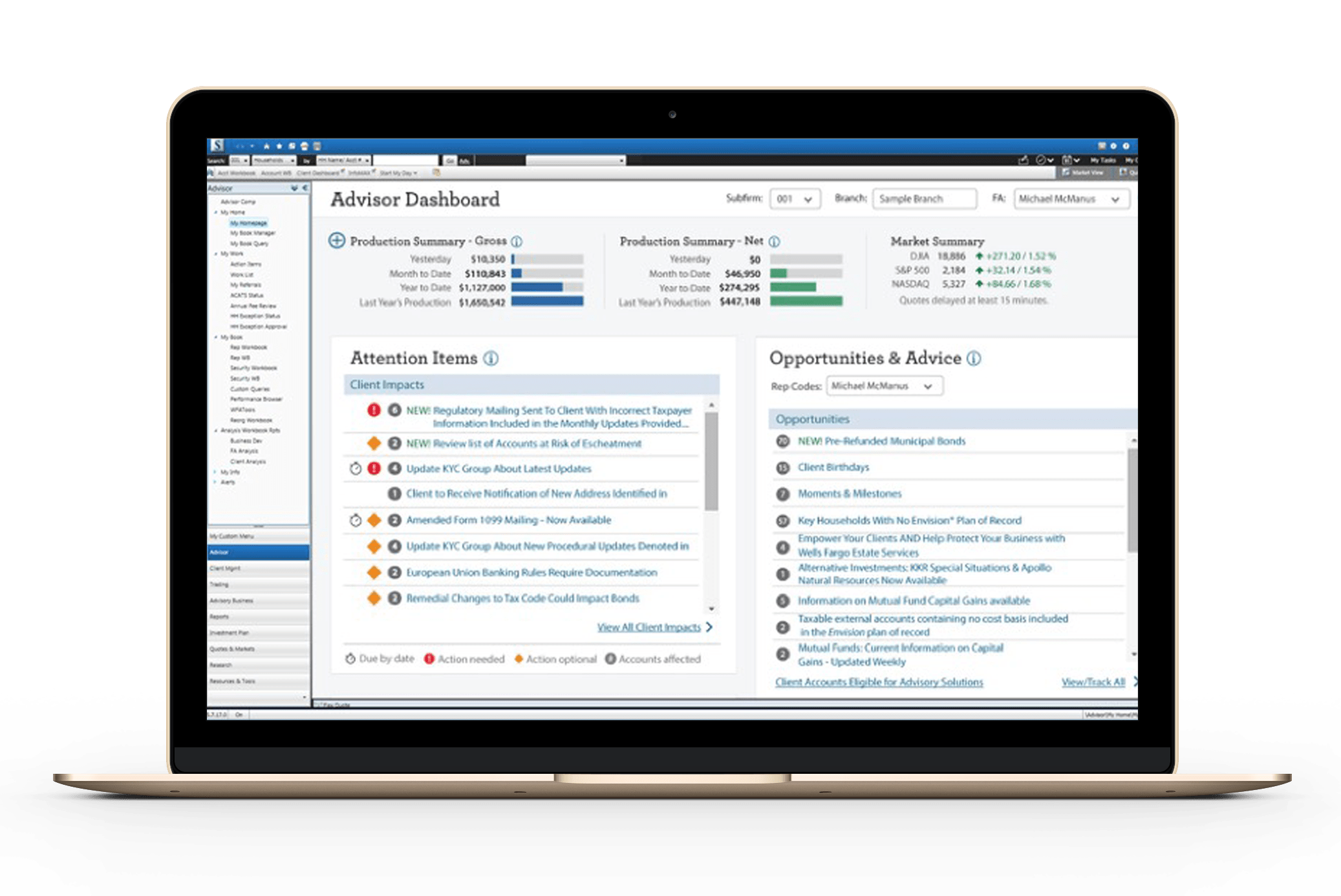

Big firm perks for your new boutique experience.

Starting off ahead of the game means having your resources ready to go. With FiNet you get all of the mentoring, services and programs you need out of the box or ready to be customized to be the personal experience your clients want.

A wide range of services to help ensure your clients have options that meet their needs.

2Lending and other banking services available through Wells Fargo Advisors (NMLS UI 2234) are offered by banking and non-banking subsidiaries of Wells Fargo & Company, including, but not limited to Wells Fargo

Bank, N.A. (NMLSR ID 399801), member FDIC, and Wells Fargo Home Mortgage, a division of Wells Fargo Bank, N.A., certain restrictions apply. Programs, rates, terms, and conditions are subject to change without advance notice.

Products are not available in all states. Wells Fargo Advisors is licensed by the Department of Business Oversight under the California Residential Mortgage Lending Act and the Arizona Department of Financial Institutions (NMLS

ID 0906158). Wells Fargo Clearing Services, LLC, holds a residential mortgage broker license in Georgia and is licensed as a residential mortgage broker (licensed number MB2234) in Massachusetts. Financial Advisor NMLS ID, if

applicable.

Equal Housing Lender

Built-in risk management so you don't have to worry.

Wells Fargo Advisors Financial Network is still responsible for supervising your securities brokerage and advisory business. You’ll work closely with your regional supervisor to make sure your business is compliant with industry rules and regulations and participate in annual compliance audits. You’ll also be covered by an errors and omissions insurance policy.

Ability to grow your team

Add advisors to your practice by getting simple approval from Wells Fargo Advisors Financial Network.

Get financial backing

Start-up capital is available through various, non-equity capitalization programs.